When you open a Capital One 360 Checking account and receive a shiny new Debit Card it is time add money to your checking account. You have to add some money before you can use them. Even if you haven’t received the debit card, you can jump to action.

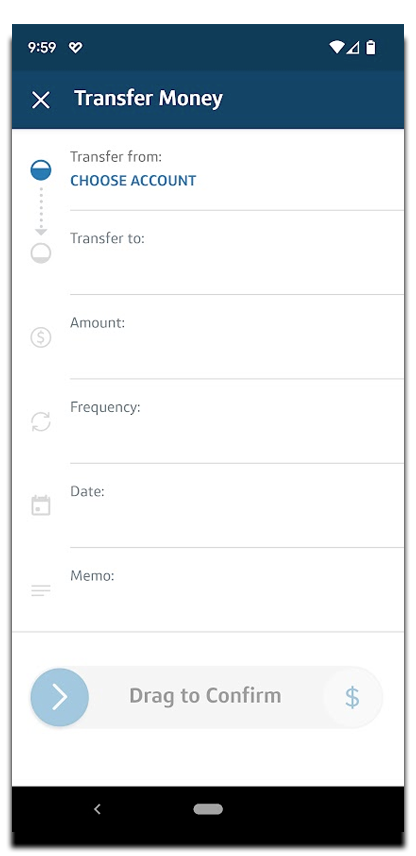

ACH Transfer

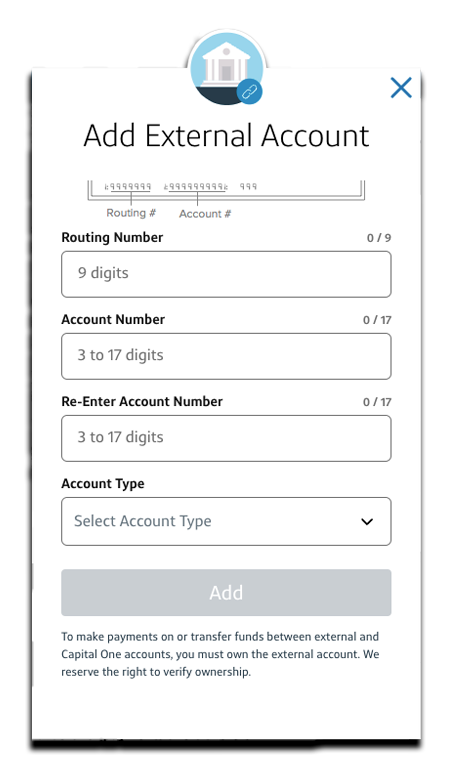

You can add money to Capital One from an external bank account. Even if you are still waiting for the Capital One Debit Card or have already received it. You can link the external bank account using routing number and account number.

After the external bank account is connected – you can schedule a deposit. Most often the deposit takes a couple of days. Then money is available to use however you want. Keep in mind that your incoming ACH transfers are limited to $10,000 per day and $25,000 per month.

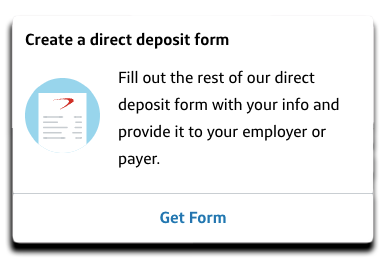

Direct Deposit

To get money to you Capital One 360 account you can set up a direct deposit of your salary. So your paycheck will come to your account right away. You can set up the direct deposit by yourself using the routing number and account number of your checking account, if your employer allows it. Alternatively you can print a VOID check and send it to your HR so that they setup it up for you. The good thing is that you can receive money a day earlier than in a big bank like Bank Of America or Chase.

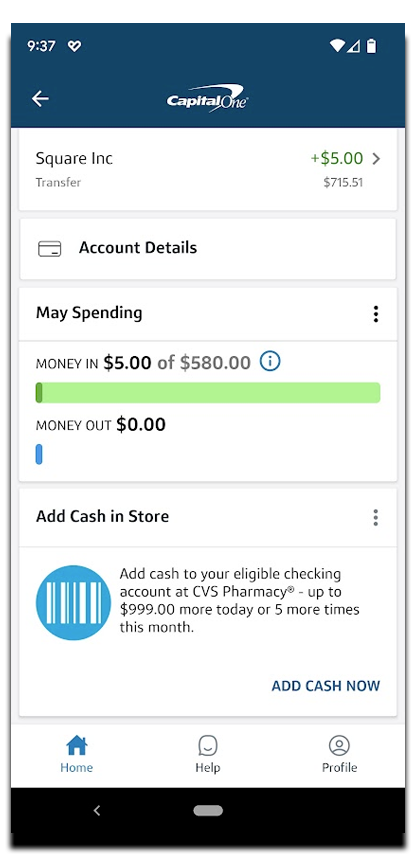

Deposit Cash

Once you receive a Capital One Debit Card you can deposit cash at Capital One ATMs. If there is no Capital One ATM nearby or you don’t have the debit card, you can deposit cash for free at a CVS Pharmacy. To do this you have to take your smartphone and open Capital Ono Mobile App. In the app find checking account and scroll down. You will find a section “Add Cash in Store”. After you generate the barcode to deposit, find a cashier and ask to make a deposit. Cashier should scan your barcode and deposit cash. Money should be available within a few minutes.

Keep in mind, that you can deposit to your Capital One 360 Checking Account up to $999 per day with 5 deposits per month.

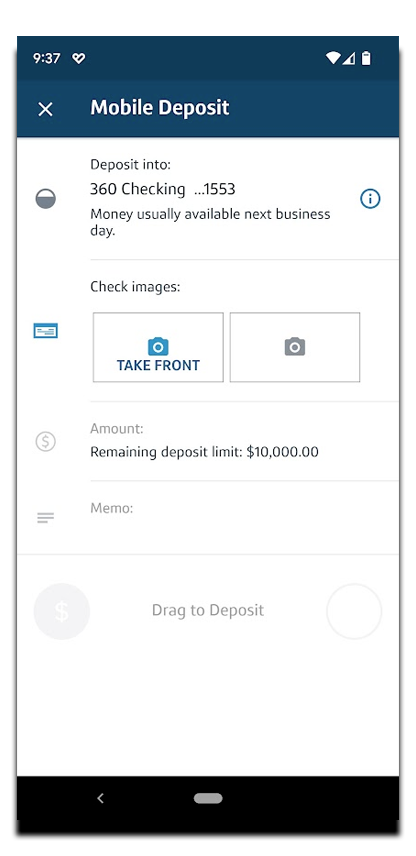

Mobile Check Deposit

Mobile Check deposit also known as remote deposit is a popular feature that saves time for those who don’t want to visit a branch or an ATM.

You can deposit paper checks to Capital One account using the Mobile Check Deposit feature. All you have to do is take a picture of the front of the check and the back. Make sure you snap the pictures on a dark background and don’t forget to sign the check. The deposit if free.

Keep in mind, that there is a deposit limit of $5,000 per day not more than $1,000 per check. These limits can change over time, once you build your relations with Capital One. For example, my limit is $10,000.

Other banks have their own deposit limits that may be higher or lower.

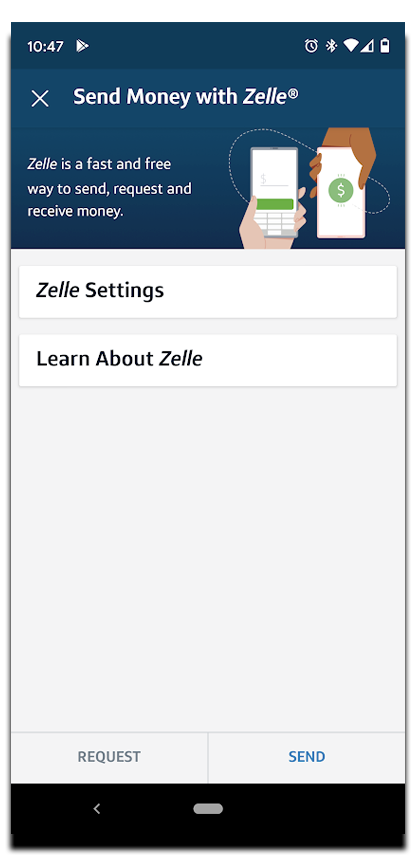

Zelle

The fifth way is to ask your friends to send you money. Capital One has integrated Zelle. It is a peer to peer payment system. Capital One allows you to transfer $2,500 per day through Zelle. This limit depends on the other bank. Most often other banks limit Zelle transfers to $2,000.

After the Zelle transfer, money should be available within minutes. However, if you are not registered, it will wait till you register.

That should be enough to get you up and running with your Capital One 360 Checking Account. However, I would recommend you to keep your Capital One Debit Card locked and use a credit card to make purchases. I like the Capital One Quicksilver Credit Card. It fits perfectly when you have a checking account with Capital One.