You can withdraw money from Chime Bank account using multiple ways. After all having a few hundred bucks on the balance is great only if you can use them. If you want to use the funds and take your money off your Chime spending account, there are few ways to do it. You can withdraw money as a cold cash or transfer to an external account. Lets list all the available options to do this.

Withdraw cash from Chime Bank

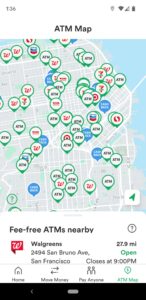

Chime Debit Card gives you access to more than 87,000 ATMs nationwide where you can withdraw money without any fee. Chime has agreements with 2 largest networks of ATMs: MoneyPass and Allpoint. MoneyPass has more than 32,000 surcharge-free ATMs. You can find these ATMs using their ATM Locator. Each ATM has MoneyPass sign. Allpoint network on the other hand has 55,000 ATMs with distinctive Allpoint sign. You cannot miss it. Keep in mind, that such ATMs can be co-branded with other banks. For example, I saw ATM that belongs to Citibank and Allpoint.

These ATMs can be found in places like Walgreens, 7-Eleven, CVS Pharmacy, and Target. Remember that you can only withdraw $500 each day. You will be charged $2.50 if you use an ATM that is not part of the network. You can also request money from a Bank or Credit Union. This operation is called Over-The-Counter Withdrawal and will cost you a fee of $2.50

You can also withdraw cash at more than 38,000 cash-back locations at major merchants across the US such as Walmart, CVS, Bed Bath and Beyond, Target, and major grocery chains like Whole Foods, Trader Joe’s, and Safeway. All you have to do is request cash back at the register when you make a purchase. The amount of cashback can range from $20 up to $100. Keep in mind, that some retailers have a minimum purchase amount to make such a withdrawal.

There are cases when this amount is too small and it is going to take your a few days to withdraw more or less meaningful amount.

Transfer money from Chime account

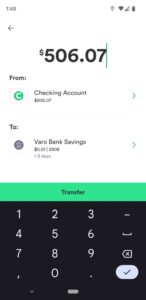

If you want to withdraw more than $500, then you can make an ACH transfer to another bank. This transfer can be initiated from Chime Bank or from other bank, if you linked your Chime Bank account to that external bank.

This way you are not limited to $500 per day. All you have to do is to link the external account and then make the transfer. Usually it can take up to 5 business days, but most often it takes 2 days.

ACH transfers from Chime Bank are limited to $10,000 per day and $25,000 per month. This should be more than enough for most cases.

Once money is transferred, you can withdraw them from ATM of the bank or use however you want.

Send a paper check

You can withdraw money from Chime by sending paper check to someone or even to yourself. All you have to do is to fill the mailing address and Chime will send the check via regular mail USPS. Be prepared that it can take a week or two for the mail to be delivered to your mailbox. Then you will be able to deposit money to another bank using the Mobile Check Deposit feature. Alternatively you can deposit it through an ATM, if the bank offers deposit enabled ATMs. Banks like Chase, Bank Of America, Wells Fargo, and Capital One have this feature built-in their ATMs. Some regional banks like Bank Of The West and credit unions allow you to deposit paper checks without any fee.

Peer-to-peer transfer

If you have a friend or family member who has an account at Chime Bank, then you can make an instant transfer. These transfers have monthly and daily limits, so make sure you don’t exceed the limit. You are limited to $2,000 per day.

These transfers are immediate and irreversible. Keep it in mind. If you send money to a wrong person, there is no way to get them back.

These are ways to withdraw money from your Chime Bank account.