Mobile check deposit, also known as remote deposit, is a feature that allows bank customers to cash checks without visiting a bank branch or going to an ATM. All you need is your smartphone and the mobile app of your bank.

This feature became especially important for online-only banks like Chime Bank and Varo Bank. At the same time, some fin-tech applications like Cash App and Spruce Money still lack this functionality.

Check Deposits using mobile phones became legal in 2004. But, by 2013 only 10% of banks adopted this feature. Now it became an industry standard, that every bank must have. Mobile check capture, as some banks call it, allows you to deposit a paper check by taking two pictures of a check you received. You should take the picture using the bank’s mobile app.

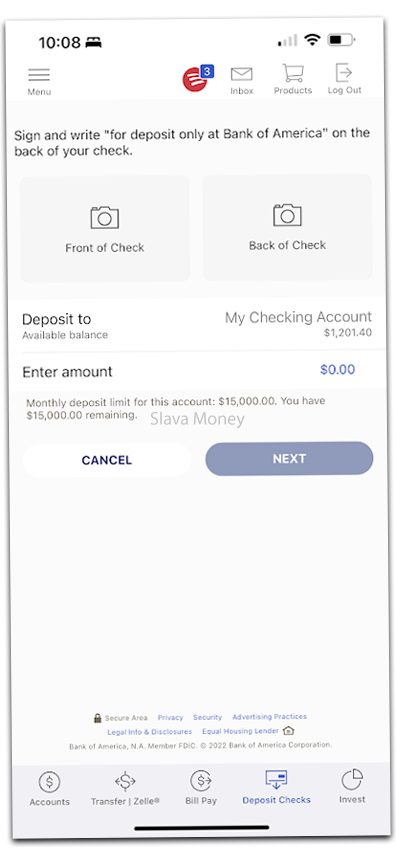

Big banks like Chase, Bank Of America, and Wells Fargo have their mobile check deposit implementations. Therefore, they often make money available on the next business day or in two business days. However, in some rare cases, it can take a week to process the check. Often these banks have high limits on deposits. For example, Ally bank allows you to deposit $50,000 per month. Bank Of America limits your deposits to $15,000 per month.

| Bank Name | Deposit Limit |

|---|---|

| Bank Of America | $15,000 |

| Chase | $7,500 |

| Wells Fargo | $11,980 |

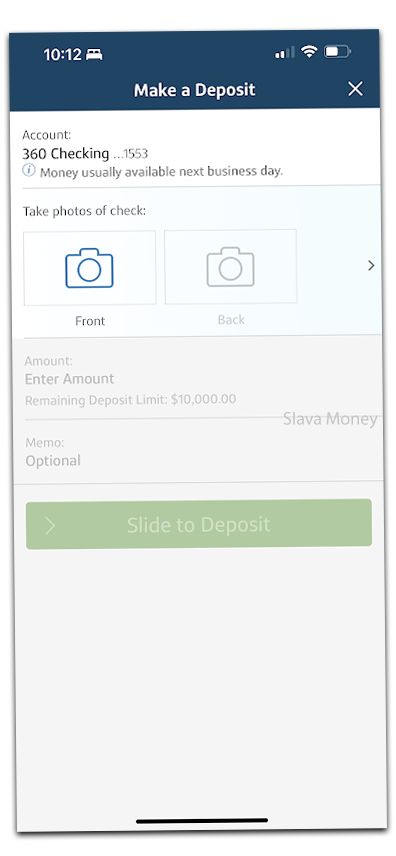

| Capital One | $10,000 |

| PNC Bank | $50,000 |

| Ally Bank | $50,000 |

Deposit check with Ingo Money

Other banks like US Bank, PayPal, GreenDot, SoFi, and Netspend have lower limits. Because they use a third-party service called Ingo Money that is offered by First Century bank. This service allows you to deposit paper checks in two ways. The first way is to deposit immediately for a small fee. The second option is to deposit in 10 business days for free. But, you should keep in mind that Ingo Money is peaky and can reject even a $10 check. Since Mobile Only banks have lower limits on deposits, so you may not be able to deposit a large check.

You may also notice, that these banks often enable this feature only after you receive a direct deposit of a certain amount. Direct deposit is your salary. It means that just an ACH transfer is not enough. So if you only earn cash, this can limit your ability to deposit paper checks.

The general recommendation is to take pictures of the check on a dark background like a wooden table or a laptop. And make sure to turn on the lights so that the phone can take a good picture.

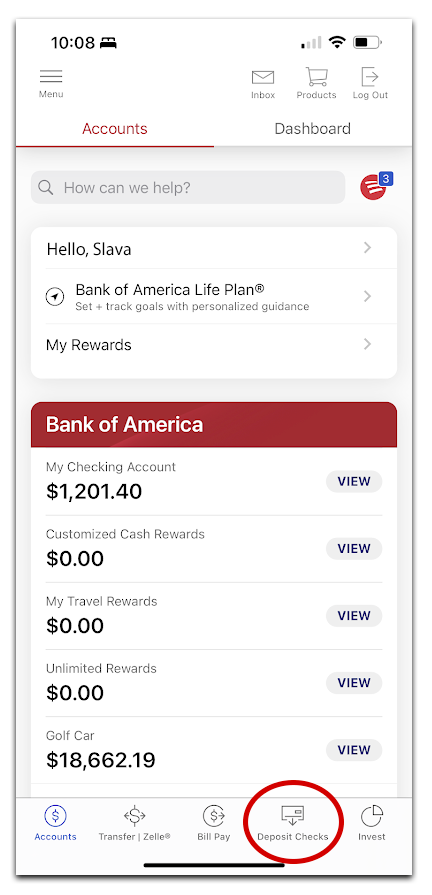

In most banking mobile apps you can find the “Deposit” button at the bottom of the dashboard. When you deposit, you have to first enter the amount of the check and then take pictures. Using the mobile app you can take pictures automatically. Make sure to place your phone right above the check. After you take the front picture of the check, you have to sign the back picture and take the back picture.

Deposited money can become available on the next business day.