When you receive a paper check, you need to deposit it to your checking account. Today mobile deposit of a paper check doesn’t take much time. Here is how you can deposit check with your phone. Most big banks make such a deposit quickly.

In a good old days to cash the check you had to visit a Wells Fargo branch and ask teller to deposit it to your account. Alternatively you could mail the check to Wells Fargo and they’ll deposit check for you. Then some ATM’s offered to deposit checks like a cash.

The Check Clearing for the 21st Century Act (Check 21) was signed into law on October 28, 2003, and became effective on October 28, 2004.

In 2004 U.S. Congress passed a law called “Check Clearing for the 21st Century Act.” The recipient of the original paper check can make a digital copy of the original check as a substitute. It meant there is no need to handle the physical check and anyone can use computer scanner or smartphone to capture image of the check and deposit electronically. The process was also called “Remote Deposit.”

First check deposit using smartphone was offered in 2009 by Element Credit Union. In 2013 Wells Fargo and other 10% of US banks already adopted this handy feature. The following years more and more banks started offering the feature called Mobile Check Deposit aka Mobile Check Capture.

Wells Fargo check deposits rules

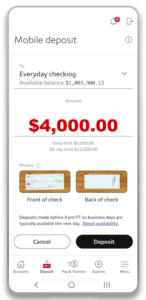

According to Wells Fargo Bank deposits made on business days by 9pm Pacific Time are typically available on the next business day. So deposits made on Monday are typically available on Tuesdays. Deposits made on weekends are often available on Tuesday’s.

Most of the time, when you deposit a check, a portion of the funds is made available to your account on the same day, with the remainder becoming available on the next business day.

Wells Fargo

However, some checks can take longer to process. It means that Wells Fargo can hold some of the mobile deposit a little longer. Usually Wells Fargo provides these details at the time of deposit or soon after.

There are few popular reasons for deposited check to be on hold.

- Insufficient funds can put the check on hold for up to 7 business days.

- Deposit of a check that was previously rejected due to insufficient funds.

- New customers can experience up to 30 days delay.

- Large deposits over $5,525 can put check on hold for up to 7 business days. Some part of the check can be released earlier.

- Frequent overdrafts can hold checks more often.

In my experience, checks on small denominations like $100 are deposited without any issues. However, check on a large amounts usually take more time than suggested by Wells Fargo.

Wells Fargo has its limits on Mobile Deposits. By default daily limit is $5,000 and $15,000 every 30 days.

Type of the paper check also plays its role. Handwritten checks tend to take more time because there is more room for a mistake. If a letter or a number is hard to recognize, then check can take more time to clear. Also it is a good idea to double check the amount with originator of the check and that checking account has enough funds. Pre-printed checks take less time to process, because issuing bank already knows how much money to allocate for the check. Government checks like tax refund are super easy to deposit, because banks trust that IRS will be able to pay the amount.